Luxury

Sectorial Thematic Club Deal

- 4 piani fuori terra, con una superficie totale di circa 2.000 mq

- 4 piani fuori terra, con una superficie totale di circa 2.000 mq

- 4 piani fuori terra, con una superficie totale di circa 2.000 mq

- 4 piani fuori terra, con una superficie totale di circa 2.000 mq

The Luxury Sector

Market sector that encompasses all companies and businesses involved in the production of high-cost consumer goods characterised by exclusivity. These goods often represent a status symbol for those who possess them. This sector includes companies that also deal with "safe haven" assets such as gold, silver and diamonds. It refers to a wide range of companies, brands, and products that belong to different sectors but share symbolic value and command a high price premium in the market. From a demand perspective, these goods tend to satisfy needs related to belonging, social stratification and aspiration.

According to the American Marketing Association, the Luxury Goods market is identified as a market for specialty goods and is limited to the highest segments of sectors such as footwear, fragrances, eyewear, jewellery, pens, lighters, luxury automobiles, clothing, furniture, alcoholic beverages and more recently, high-tech goods. Given the wealth of investment opportunities in this sector, WeInvest has dedicated a specific Sectorial Thematic Club Deal to it.

Sector Characteristics

Business Model

The Luxury market has rather fluid boundaries. It encompasses the most prestigious areas of various sectors and sub-sectors. Among the main ones are:

- Fashion Industry this sector deals with the design, production and marketing of high-end clothing and fashion accessories;

- Jewellery and Goldsmith, this involves the creation of jewellery items (rings, earrings, necklaces, bracelets, etc.) primarily using metals such as gold, silver, platinum, as well as precious gemstones, pearls, corals and more;

- Design, Luxury design refers to the creation of high-end furniture using exquisite materials, precious decorations and refined finishes, often associated with the concept of Made in Italy;

- Wellness, this category is related to Luxury Hotels and Spas, as well as specific treatments for psycho-physical well-being;

- Luxury Yachting, this encompasses the luxury yacht industry within the broader recreational boating sector. It includes motor yachts, mega yachts, luxury sailing boats and luxury inflatable boats (RIBs).

Status

The luxury market is increasingly aligning itself with consumer needs to meet a concept of luxury that no longer solely identifies with expensive goods, but encompasses a broader lifestyle connotation. Therefore, the luxury market is highly competitive and this competition is no longer confined to a specific sector identifiable by a particular range of products, but rather extends across various sectors on a larger scale. Today, the industry is characterised by diversified companies and multi-brand groups that offer not only tangible goods but also intangible experiences. The luxury sector follows cyclical patterns and exhibits particular characteristics in terms of the relationship between disposable income and purchasing quantity. As disposable income increases, the purchase of luxury goods increases more than proportionately, creating a potential market larger than that of normal and inferior goods under the same conditions. Overall, in the past two decades, there has been a steady increase in luxury goods, even during periods of crisis (2007-2014). Taking all this into account, the sector is defined as experiencing strong and stable growth, ensuring secure and long-lasting investments.

Market Risks

In a period of market stagnation and increasing consumer polarisation between low-cost brands and luxury brands, it is important to evaluate the risks associated with investing in the luxury sector. These risks include those related to macro PEST factors (political, economic, social, technological), such as:

- Possible global economic recession;

- Potential political instability and depreciation of currencies in emerging countries;

- Environmental risks that may have a greater financial impact on luxury sector activities in the next two years;

- Socio-political events such as the Covid-19 pandemic and the Russo-Ukrainian conflict.

In addition to the aforementioned PEST factors, attention should also be given to possible "flash in the pan" trends and historic luxury brands that may have begun to decline.

Market Trends

Like other sectors, the luxury industry has also had to respond to new market needs and demands in recent years, giving rise to original trends. Currently, companies operating in various segments of the luxury market are focusing on providing a new type of customer experience to their clientele, making the experience as sustainable and digital as possible. Some trends related to the luxury sector include the expansion of online sales, including luxury products, through e-commerce and the communication of alternative values primarily related to environmental sustainability and animal welfare.

Market Values

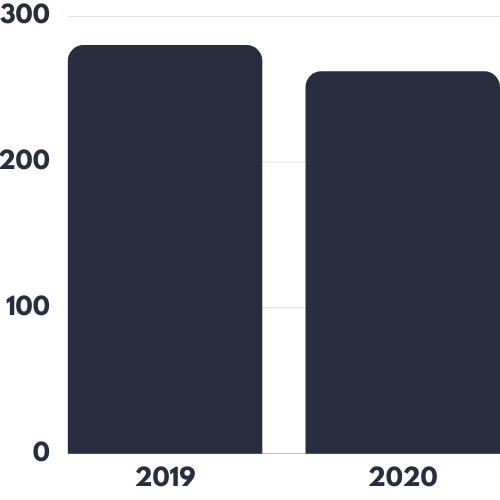

Revenue Trends (in Billion of €)

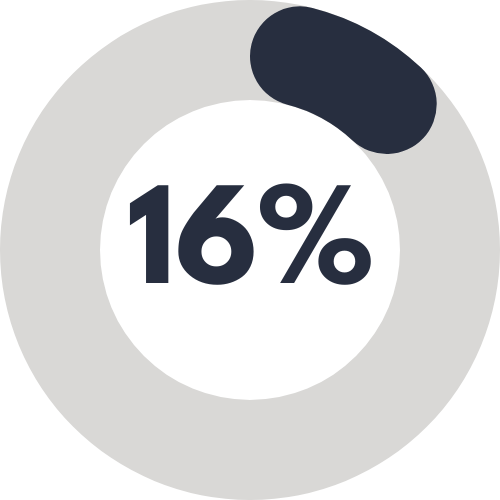

Contribution % to GDP (Italy, 2021)

Get Value to your Investments for an Innovative, Real and Sustainable Economy & Finance

Improve your ability to conclude deals, with a clear reduction in closing times and maximising the profitability of each Investment, never losing sight of social ethics and sustainability: join the Network Club Deal WeInvest.